华金教育 | 2023-03-31 | 1546

1、Question:A risk consultant has been tasked with assessing a small bank’s liquidity risk profile. While reviewing a presentation produced by the bank, the consultant comes across a list of early warning indicators used to signal potentially heightened liquidity risk.Which of the following trends should the consultant consider as the strongest warning signal for potential liquidity risk at the bank?

A、Decrease in stock price of the bank’s peers but not in the stock price of the bank itself.

B、Increase in credit lines received from other financial institutions .

C、Widening spreads on the bank’s issued debt and credit default swap.

D、Significant asset growth funded by an increase in stable liabilities .

2、Question:A risk manager is estimating the market risk of a portfolio using both the arithmetic returns with normal distribution assumptions and the geometric returns with lognormal distribution assumptions. The manager gathers the following data on the portfolio:

(1)Annualized average of arithmetic returns: 16%

(2)Annualized standard deviation of arithmetic returns: 27%

(3)Annualized average of geometric returns: 13%

(4)Annualized standard deviation of geometric returns: 29%

(5)Current portfolio value: EUR 5,200,000

(6)Trading days in a year: 252

Assuming both daily arithmetic returns and daily geometric returns are serially independent, which of the following statements is correct?

A、The 1-day normal 95% VaR is equal to 1.63% and the 1-day lognormal 95% VaR is equal to 1.76%.

B、The 1-day normal 95% VaR is equal to 2.69% and the 1-day lognormal 95% VaR is equal to 2.88%.

C、The 1-day normal 95% VaR is equal to 2.74% and the 1-day lognormal 95% VaR is equal to 2.92%.

D、The 1-day normal 95% VaR is equal to 3.26% and the 1-day lognormal 95% VaR is equal to 3.48%.

3、Question:A UK-based retail brokerage firm has recently experienced rapid growth through a series of acquisitions and plans to improve its operational resilience in order to comply with new requirements issued by national regulators. The CRO asks an operational risk manager to assess best practices in this area and to suggest potential actions that the firm should take to meet this objective. Which of the following actions would be most appropriate for the manager to recommend in order to comply with the regulatory guidelines concerning operational resilience for important business services?

A、Increase the existing performance incentives for the firm’s brokers and sales representatives to further enhance their productivity.

B、Reduce costs by consolidating the human resources and payroll functions of the acquired firms into a single firm-wide process.

C、Reserve additional economic capital for operational risk to provide an incremental capital cushion against potentially extreme operational losses.

D、Increase the bandwidth capacity for the firm’s equity trading platform and procure remote backup capabilities so the platform can continue to function during an outage.

4、Question:The board of directors of a midsize bank has recommended that the bank improve its processes for managing operational risk. The CEO asks an enterprise risk manager to review the bank’s tools and processes for managing operational risk and to suggest improvements that are consistent with Basel II and Basel III guidelines for operational risk governance. The bank also plans to adopt the new Basel III standardized approach (SA) to determine its regulatory capital for operational risk. Which of the following actions should the manager recommend that the bank take?

A、Use third-party outsourcing agreements to replace most internal controls performed by senior managers and business line managers .

B、Develop an internal approach to model the distribution of operational risk losses and use it to determine the bank’s regulatory capital.

C、Require an independent review of the bank’s operational risk management framework.

D、Designate the risk management function as the primary owner of risk exposures within each business line .

5、Question:Due to lack of available investment opportunities in public markets, a pension fund decided to hire an investment consultant to assess the potential for investing in illiquid markets in the US. Which of the following characteristics of illiquid markets in the US should the consultant present to the pension managers?

A、Municipal bonds are usually more liquid than pinksheet over-the-counter equities.

B、The traditional public, liquid markets of stocks and bonds are larger than the total wealth held in illiquid assets.

C、The share of illiquid assets in institutional portfolios has generally gone up in the past 2 decades.

D、During the 2008-2009 Financial Crisis, liquidity dried up in repo markets but not in commercial paper markets.

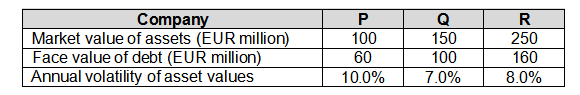

6、Question:A credit manager in the counterparty risk division of a large bank uses a simplified version of the Merton model to monitor the relative vulnerability of its largest counterparties to changes in their valuation and financial conditions. To assess the risk of default of three particular counterparties, the manager calculates the distance to default assuming a 1-year horizon (t=1). The counterparties: Company P,Company Q, and Company R, belong to the same industry, and are non-dividend-paying firms. Selected information on the companies is provided in the table below:

Using the information above with the assumption that a zero-coupon bond maturing in 1 year is the only liability for each company, and the approximation formula of the distance to default, what is the correct ranking of the counterparties, from most likely to least likely to default?

A、P; R; Q

B、Q; P; R

C、Q; R; P

D、R; Q; P

7、Question:Bank HJK has written puts on Bank PQR stock to a hedge fund and sold CDS protection on Bank PQR to a manufacturer. Bank HJK and Bank PQR operate in several of the same businesses and geographies and their performances are highly correlated. Many in the market are concerned that rising interest rates could negatively impact the credit quality of Bank HJK’s numerous borrowers, which in turn would increase the credit spread of Bank HJK. From the perspectives of the hedge fund and the manufacturer, which of the following is correct with respect to their counterparty risk exposure to Bank HJK?

A、Right-way risk Wrong-way risk

B、Wrong-way risk Right-way risk

C、Right-way risk Right-way risk

D、Wrong-way risk Wrong-way risk

8、Question:A large pension fund requires that the fund’s managers do not breach the 2% tracking error limit at any point in time. A fund manager’s performance for the most recent period is summarized below:

(1)Average return: 2.8%

(2)Volatility of returns: 1.9%

(3)Average return in excess of the benchmark (average active return): 0.6%

(4)Volatility of active returns: 1.7%

If the current risk-free interest rate is 1.2%, which of the following is correct?

A、The manager’s average active return is below 2%, therefore the manager breached the limit.

B、The manager’s average return in excess of the risk-free interest rate is below 2%, therefore the manager breached the limit.

C、The volatility of active returns achieved by the manager is below 2%, therefore the manager did not breach the limit.

D、The volatility of returns achieved by the manager is below 2%, therefore the manager did not breach the limit.

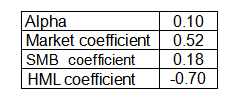

9、Question:A risk analyst is evaluating an investment portfolio using the Fama-French three- factor model. The analyst regresses thirty years of weekly portfolio returns against the three factors of the model. The analyst obtains the following regression results:

Assuming all estimated coefficients are statistically significant, which of the following is correct?

A、There is a positive correlation between portfolio return and the size factor, which indicates that the portfolio moves together with large-cap stocks.

B、There is a positive correlation between portfolio return and the value factor, which indicates that the portfolio moves together with growth stocks.

C、There is a negative correlation between portfolio return and the size factor, which indicates that the portfolio moves together with large-cap stocks.

D、There is a negative correlation between portfolio return and the value factor, which indicates that the portfolio moves together with growth stocks.

10、Question:A bank owned five retail branch buildings that were destroyed in a hurricane. Several months later, the bank received a settlement payment from its insurance company that covered a portion of the value of the buildings. A risk manager is preparing an operational risk incident report of this loss for the national regulator and wants to ensure that all the appropriate costs are included in the report and that the reporting process meets best industry practices. Which of the following statements correctly describes how the losses from this event should be reported?

A、The report should include the gross loss incurred as a result of the event, but not the settlement payment received from the insurance company.

B、The reported loss should include an estimate of the opportunity costs of banking business lost at the affected branches.

C、The reported loss should include the legal costs paid to obtain construction permits to rebuild the destroyed branch buildings .

D、The losses should be reported as a market risk event rather than an operational risk event because they resulted in a reduction of the value of the bank’s real estate portfolio.