华金教育 | 2025-01-08 | 4624

1、Question:The CFO and CRO at a French property-casualty insurer are discussing the impact recent flooding in Europe is having on their company. They are concerned about a surge in property insurance claims causing the company’s regulatory capital to fall below the solvency capital requirement (SCR) prescribed under Solvency II. Which of the following would be a result of this situation?

A、The company will be prevented from writing new property-casualty policies.

B、A plan to bring capital above the minimum capital requirement must be formulated.

C、The company can lower the capital charges assessed for determining the capital requirement by decreasing investment risk.

D、A waiver of capital requirements can be granted by the French insurance regulator.

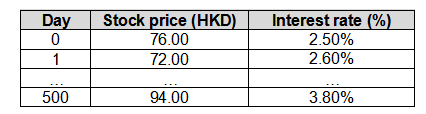

2、Question:A risk analyst at a hedge fund is conducting a historical simulation to estimate the ES of a portfolio. The value of the portfolio at market close of any given day depends on the price of a stock and the level of an interest rate at the close of that day. The analyst uses closing values of these variables on the most recent 501 trading days as the historical dataset for the simulation and collects the following data, with Day 0 representing the first data point and Day 500 representing the last data point of the historical period:

What stock price and interest rate would be most appropriate for the analyst to use in the scenario of the historical simulation for Day 501?

A、The stock price would be HKD 89.05, and the interest rate would be 3.90%

B、The stock price would be HKD 89.05, and the interest rate would be 3.95%

C、The stock price would be HKD 92.00, and the interest rate would be 3.90%

D、The stock price would be HKD 92.00, and the interest rate would be 3.95%

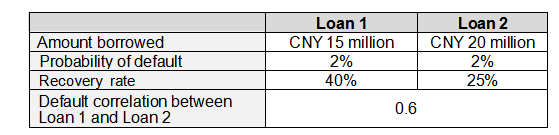

3、Question:A risk manager at a bank is speaking to a group of analysts about estimating credit losses in loan portfolios. The manager presents a scenario with a portfolio consisting of two loans and provides information about the loans as given below:

Assuming portfolio losses are binomially distributed, what is the estimate of the standard deviation of losses on the portfolio?

A、CNY 1.38 million

B、CNY 1.59 million

C、CNY 3.03 million

D、CNY 3.36 million

4、Question:Dutch tulip mania is considered one of the first major financial bubbles.It occurred in 1636-37 when introduction of tulips imported from Turkey generated extremely high demand which led to an astronomical jump in prices. Tulips were first traded as forward contracts, but the government passed laws allowing certain contracts to be transformed to options contracts . Short selling was strictly prohibited.

After the price of tulips rose so high that a single bulb exceeded the cost of an average home, the price collapsed, and many investors went bankrupt. Which of the features of exchange markets listed below would have helped to prevent or mitigate the tulip mania?

A、If Dutch exchanges had allowed only forward contracts, tulip sellers would have been contractually required to pay the full value of the contracts at expiry, which would have minimized speculative trades.

B、By allowing the netting of multiple trades in the portfolio, exchanges help offset the risk from long and short trades, which can decrease potential losses in the portfolio.

C、The main role of an exchange is to enforce payments by counterparties on both sides of the trades, which would have eliminated credit risk for tulip traders.

D、Exchanges offer multiple protection tools that help against counterparty credit risk, but those tools do not protect against economic risk.

5、Question:A credit risk analyst at a wholesale bank is estimating annual default probabilities of a 5-year loan that has just been extended to a corporate borrower. The analyst determines from rating agency data that the 5-year cumulative default probability of bonds from this borrower with identical terms and seniority is 6.2%, and uses this information to calculate the 5-year survival rate for the borrower. If the borrower’s average hazard rate for the first 4 years of the loan is 1.1%, what is the unconditional default probability of the borrower during year 5 of the loan?

A、1.71%

B、1.80%

C、1.90%

D、1.98%

6、Question:A risk manager at a bank is presenting at a seminar on derivative contracts to a group of newly hired junior analysts. The manager focuses on the features and uses of derivative contracts traded by financial market participants. Which of the following statements, if made by the manager, would be correct regarding these derivative contracts?

A、A derivative contract allows a transfer of risks that is beneficial to both parties in the contract.

B、Speculators use derivative contracts traded on exchanges, while hedgers use contracts traded in over-the-counter markets.

C、Complex derivatives created with mortgages by banks in the years leading up to the 2007 – 2009 global financial crisis limited demand for housing and reduced the severity of the crisis.

D、Derivative contracts such as forwards, futures, or options have linear payoff functions that depend on the value of the underlying asset.

7、Question:An analyst wants to price a 6-month futures contract on a stock index. The index is currently valued at USD 750 and the continuously compounded risk-free rate is 3.5% per year. If the stocks underlying the index provide a continuously compounded dividend yield of 2.0% per year, what is the price of the 6-month futures contract?

A、USD 744.40

B、USD 755.65

C、USD 761.33

D、USD 763.24

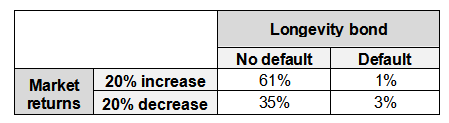

8、Question:A portfolio manager is assessing whether the 1-year probability of default of a longevity bond issued by a life insurance company is uncorrelated with returns of the equity market. The portfolio manager creates the following probability matrix based on 1-year probabilities from the preliminary research:

Given the information in the table, what is the probability that the longevity bond defaults in 1 year given that the market decreases by 20% over 1 year?

A、3.00%

B、4.00%

C、7.89%

D、10.53%

9、Question:For a sample of 400 firms, the relationship between corporate revenue (Yi) and the average years of experience per employee (Xi) is modeled as follows:

Yi = F1+F2*Xi+ci i = 1, 2 ..., 400

An analyst wants to test the joint null hypothesis that β 1 = 0 and β2 = 0 at the 95% confidence level. The p-value for the t-statistic for β 1 is 0.07, and the p-value for the t-statistic for β2 is 0.06. The p-value for the F-statistic for the regression is 0.045.Which of the following statements is correct?

A、The analyst can reject the joint null hypothesis because each β is different from 0 at the 95% confidence level.

B、The analyst cannot reject the joint null hypothesis because neither β is different from 0 at the 95% confidence level.

C、The analyst can reject the joint null hypothesis because the F-statistic is significant at the 95% confidence level.

D、The analyst cannot reject the joint null hypothesis because the F-statistic is not significant at the 95% confidence level.

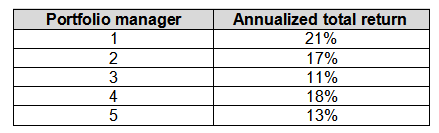

10、Question:The CIO of a global macro fund is assessing the performance of the international portfolio managers of the fund. The CIO gathers the annualized total returns of a sample of the managers as presented in the following table:

The CIO calculates the central moments of these returns. What is the correct unbiased sample variance of the returns data?

A、0.00128

B、0.00160

C、0.00288

D、0.00360